Only 29% of Americans are financially stable. Americans are so bad at finances that many people are thousands of dollars deep in debt beyond their home mortgage.

If you don’t know how to keep track of bills and the income you have coming in, it’s easy to get lost down a hole of financial despair.

Do you want to learn more about how to keep track of finances, so you can work toward better financial health? Continue reading this article to get better at keeping track of money and bills.

5 Steps to Learn How to Keep Track of Bills & the Money You Make

① Make a List of All Your Bills

It doesn’t matter how small a bill is, you need to list it. Even if you think that $12 for Netflix isn’t a lot — list it.

You can’t move on to the next step until you have absolutely everything down. Go through your bank account and credit card statements from the previous month and see if you missed any bills.

Don’t forget to count any credit card payments you need to pay into the bills you have each month.

② Create an Accurate Budget

Creating a rough estimate budget might feel a little freer, but it’s not going to do you any favors. Bills likely aren’t the only thing you’re spending money on, so list any money you plan on spending going out to eat, other entertainment, for gifts, and anything else.

You might even create a category for miscellaneous expenses, so you do have a little wiggle room. Definitely, do not forget to create a savings category in your budget, so you can start getting ahead.

③ Update Your Budget As Necessary

Keep in mind that your life is going to change from time to time. You need to make sure you’re reviewing your budget, bank account, and credit cards. Did you add a new subscription box that’s going to be another $49.99 out of your budget each month, but forgot to add it? Maybe you stopped a subscription for $14.99 and now have a little more free cash.

④ Different Ways to Track

Depending on the way you like to do things, there are different ways to track your income and expenses. Some people like more hands-on methods and others are good at doing things in a high tech manner.

⎆ Low Tech Methods

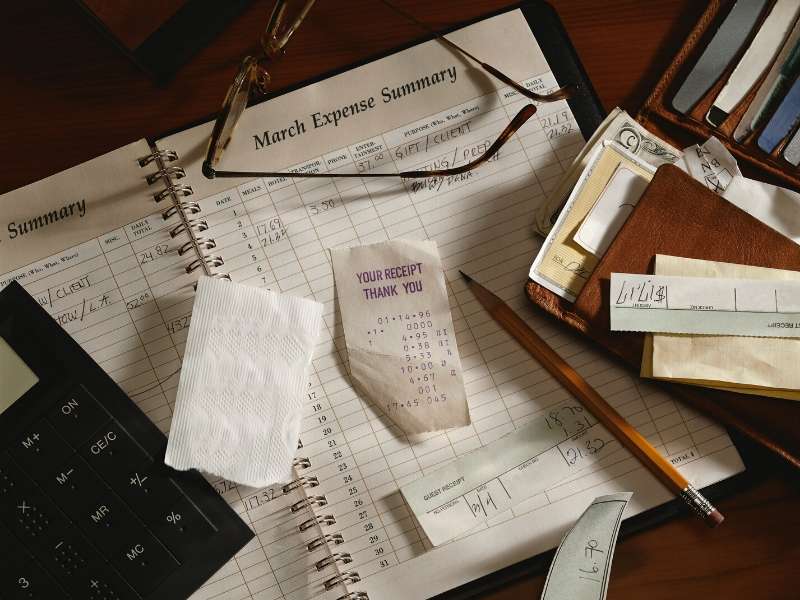

If you want to keep things simple and hands-on, one of the ways you can do this is with a simple pencil and paper. Write down when money comes in and goes out. Most people used to at least do this with their checkbooks, but now with online banking, hardly anyone is doing it.

Tracking using a pencil and paper might be a little too tedious and hard to keep track for some, so another option is using envelopes. When money comes in, you put the money in the envelope that corresponds with that amount. For instance, if your electric bill is usually $150, then you’d put $150 in the electric bill envelope.

When the money is gone from the envelopes, you obviously know that you’ve spent it. If you don’t get physical paycheck stubs, but you’d like to have one to keep track of things, you can use a fake pay stub template to print out pay stubs as you need them.

⎆ High Tech Methods

If the low tech methods are giving you a heart attack trying to figure out how you’ll keep up, try these more high tech methods.

You can track your income and bills by using a computer spreadsheet. There are lots of templates you can use and ways to customize your budget, so it’s super simple for you to stay on track.

One thing to keep in mind is that it might be easy for you to skip a day or two of entering your income and expenses. If you totally forget or fall behind, you might end up going over budget and even overdraft your bank account or go over your credit card limits.

Many high tech lovers opt to use apps. Since they always have their phone on them, it’s easy to enter in that random latte purchase you didn’t plan on. There are so many options for budgeting apps, so try some of the different options available and see which ones make sense to you.

Look for an app that allows you to enter expenses with a category and the date. You should also have the ability to search for transactions, so it is easy to keep up with what you’re spending and earning.

⑤ Negotiating What Works for Your Household

When you’re putting your budget together and figuring out how you’re going to track everything, make sure you keep in mind that not everyone thinks the same. If you’re married or have a partner, you need to communicate and see things from their point of view.

While you do want to keep up with a budget, you also need to be careful that you don’t put a strain on your relationship when trying to work out the money issue. Negotiate terms for how you’ll discuss money, your new tracking system, and anything else you think you might have disagreements over.

Now You Know How to Keep Track of Bills!

Now you have more of an idea of how to keep track of bills and income. You’ll be able to get your finances on the right path, so you can have a bright financial future.

Images Courtesy of Canva.

4 Top Reasons Why You Need To Invest in Home Renovation

Some Fun & Amazing Ways To Enjoy Your Deck

Benefits of Using Steam Cleaners To Sanitize Your Home

Carpet, Tiles, and Hardwood: Which Flooring is Right For You?